With five states voting in favor of new marijuana markets last month, Metrc sees fresh opportunities to extend its dominance in the seed-to-sale tracking business by winning new government contracts.

The Florida-based company also acknowledged its track record hasn’t been perfect – Metrc’s software has experienced occasional outages and slowdowns – but says it wants to hear from marijuana businesses with feedback on how to improve the service.

“We welcome the constructive criticism and we welcome the ideas, because we’re committed over the long haul to continually reinvest back into the system and make it better and more efficient over time,” said Metrc Chief Operating Officer Lewis Koski, a former director of Colorado’s Marijuana Enforcement Division.

The state of Metrc

Metrc began as a wholly owned subsidiary of Franwell but now operates as a Franwell affiliate under the Metrc brand.

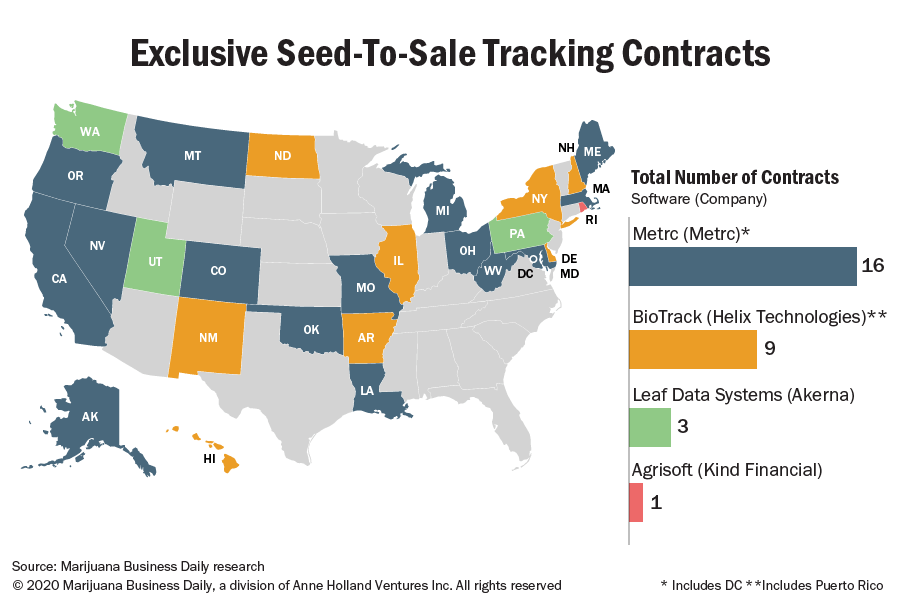

The company remains the top contractor for government seed-to-sale tracking operations in the United States, a position it has held for several years.

Metrc now has contracts in 15 states plus Washington DC, including three additions this year: Maine, Oklahoma and West Virginia.

Koski said the company boasts a 100% contract-renewal rate.

He attributed the company’s leading track-and-trace position to fast deployment times, leveraging its experience in multiple markets and high retention rates for its approximately 130 employees.

“I think the other thing that sets us apart is exclusivity,” Koski said.

“Unlike all the other track-and-trace providers, we don’t offer any ancillary services to the industry (such as point-of-sale systems or consulting services).

“So we’re primarily focused on the inventory accountability as required in law and through regulation, and so we really narrowly tailor what we do to those things.”

Metrc’s revenue comes from governments that typically pay the company to host track-and-trace data in its system as well as from state marijuana licensees who pay $40 per month to access the software and tracking tag fees of 45 cents per plant and 25 cents per product.

The private company doesn’t disclose revenue figures, but Koski said Metrc continually reinvests its revenues into improving its product and support services.

A 2018 funding round worth $50 million was invested in Metrc’s system and support services, staff expansion and additional support and training positions, Koski said.

Metrc’s expansion plans

After voters in Arizona, Mississippi, Montana, New Jersey and South Dakota legalized new marijuana markets in the Nov. 3 election, Koski said Metrc sees new opportunities on the state-government horizon.

“We anticipate that there will be opportunities there for states who are looking to implement a robust regulatory framework,” he said, “but they’ll want to follow suit with what other successful states have done and incorporate seed-to-sale tracking into the regulatory framework.”

Metrc responds to criticisms

For marijuana businesses that must use Metrc to comply with state regulations, system slowdowns or outages can be a serious problem.

Examples include 2018 outages and slowdowns in Maryland’s medical marijuana market that led to lost sales and a February glitch that kept Michigan MMJ dispensaries from looking up patients.

In California, the largest single U.S. market, Metrc’s 2019 rollout was slow and uneven, and there were reports of early confusion around how to use the system.

In Nevada, issues with Metrc reporting discrepancies in 2019 led to calls for more training.

Regarding past glitches and outages in Metrc, Koski acclaimed the system’s “really strong” uptime record while acknowledging that record isn’t perfect.

Jennifer Gallerani, director of compliance for Nevada-based cannabis software and services firm Blackbird, has trained users on how to use Metrc.

“It is not user-friendly. It’s very hard to learn,” Gallerani said.

“There’s not an easy undo button. So, when you make a mistake, it’s very hard to correct that mistake and find it and undo it.

“And so the learning curve is incredibly steep.”

In response to those criticisms, Metrc’s Koski said he believes the interface is designed for user-friendliness and efficiency and noted that Metrc commonly enhances its systems more than 150 times a year.

But “those types of outcries are things that we take very seriously and we take a very close look at,” Koski said.

Koski said Metrc analyzes feedback from industry user groups to “look for new ways to evolve the system or evolve our training,” adding that new training tools should be released in roughly six to nine months.

API integration concerns

Metrc interaction has been a key challenge for developers of third-party marijuana business software such as point-of-sales systems, which need to communicate with Metrc’s database through an application programming interface (API).

Blackbird’s Gallerani and David Hua, CEO of San Francisco-headquartered cannabis point-of-sale software firm Meadow, are members of a consortium of companies that rely on Metrc integration in California, collaborate on problems and raise those issues with state regulators.

The group found that from April through September, availability for Metrc’s California API integration ranged between 91.8% and 98.8%, below what Gallerani said should be a 99.9% uptime standard.

“So, just because your track-and-trace system is not responding to your API calls or is not working, you can’t log in, the distributor sitting at the dispensary has to stop what they’re doing and go back home or wait until it goes back up again,” Hua said.

Metrc’s Koski cited rapidly increasing levels of API traffic in California that led to slowdowns this year, partly related to spiking sales during the coronavirus pandemic as well as factors such as inefficient API integrations that called Metrc’s database too frequently.

Metrc instituted API rate limiting in October, capping the frequency at which third-party software pings the Metrc database.

Koski said Metrc also optimized its system and worked directly with third-party integrators. He added that the problem is largely resolved.

Meadow CEO Hua said the rate limiting has helped, although it took a great deal of back-and-forth between third-party API integrators such as his company, California regulators and Metrc to get there.

“I think (Metrc has) been responsive in trying to move the ball forward on fixing what’s going on,” Hua said.

“That being said, it’s been very challenging because their client is the state, and the state is the one that mandates the changes and the things that they want to see.

“But then it was the responsibility of industry, almost, to educate the regulators.”

Solomon Israel can be reached at solomon.israel@mjbizdaily.com