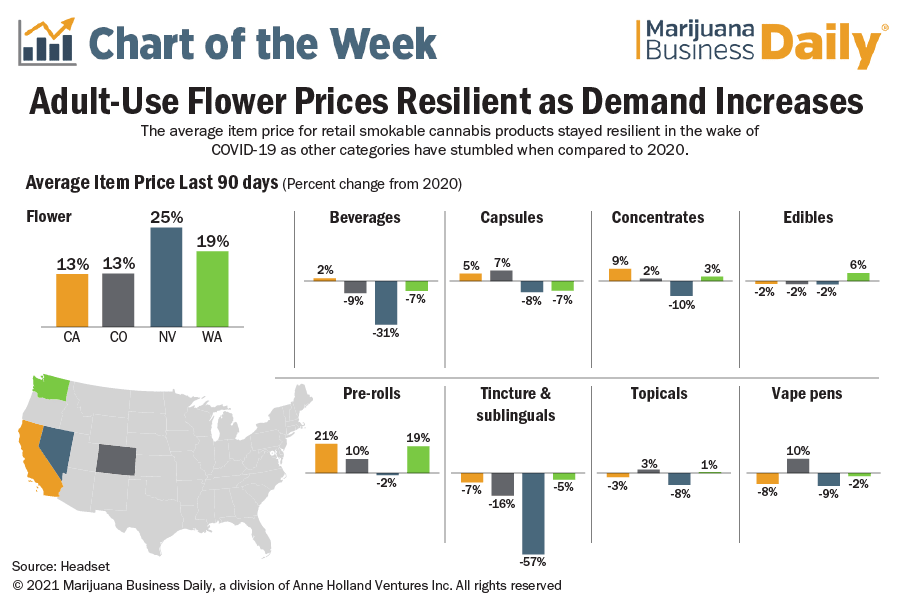

The average retail price for smokable recreational marijuana products in four Western states continued to increase throughout the coronavirus pandemic, thanks to record demand.

Retail flower prices in California, Colorado, Nevada and Washington state collectively grew 17%, with the price of pre-rolls also increasing 15%.

The retail data, provided by Seattle-based cannabis analytics company Headset, reflects the average item price for the past 90 days compared to the same period last year.

The rise in prices is good news for cannabis retailers, because wholesale flower prices continue to increase because of robust consumer demand.

Colorado’s wholesale flower price reached its highest level since 2016, with the average market rate per pound of flower jumping 31% from the beginning of October 2020 to the end of January of this year.

While the retail price of smokable adult-use marijuana products rose in California, Colorado, Nevada and Washington state, the retail price of other product categories were a mixed bag depending on the market.

Nevada experienced a 25% increase in retail flower prices over the past 90 days versus a year earlier, but all other categories fell.

Prices in the state’s infused beverage category declined 31% over the same period last year, while the tincture and sublingual category tumbled 51%.

Average Item Price Last 90 Days (Percent change from 2020)

Adult-use marijuana percent change in price since 2020 for combined market including California, Colorado, Nevada and Washington state. Source: Headset.| Category | Average item price (2020) | Average item price (2021) | Percent change |

|---|---|---|---|

| Beverages | $13.05 | $12.37 | -5.21% |

| Capsules | $27.32 | $30.34 | 11.05% |

| Concentrates | $18.94 | $19.58 | 3.38% |

| Edibles | $15.65 | $14.82 | -5.30% |

| Flower | $25.62 | $29.85 | 16.51% |

| Pre-rolls | $8.40 | $9.67 | 15.12% |

| Tincture & sublinguals | $39.29 | $35.21 | -10.38% |

| Topicals | $25.58 | $25.25 | -1.29% |

| Vape pens | $32.98 | $31.32 | -5.03% |

The pricing shift is no surprise: Nevada’s marijuana market faced significant losses in tourism dollars because of the pandemic-related shutdown of the travel and convention industries.

Governments in most state-legal marijuana markets labeled cannabis businesses as essential during the coronavirus pandemic, leading to double-digit sales growth.

However, sales for Nevada’s combined medical and recreational markets grew only 7% through September 2020, the latest numbers available.

That said, sales in September jumped 32% compared to 2019.

While Nevada has stabilized with the support of local consumers, they prefer a different product mix than convention travelers, declining pricing data in some categories shows.

Andrew Long can be reached at andrew.long@mjbizdaily.com.