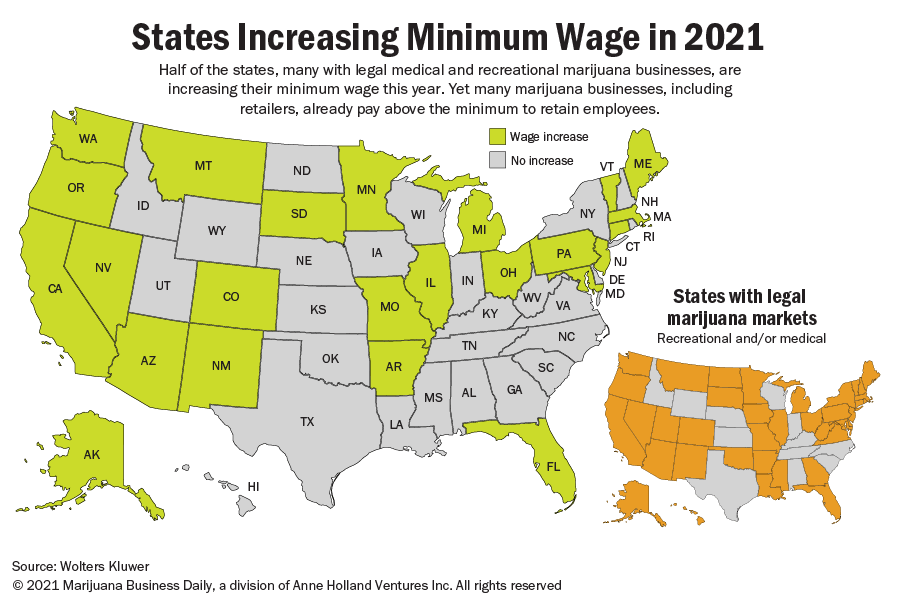

Virginia lawmakers on Saturday narrowly approved compromise legislation legalizing a commercial recreational marijuana program that could generate nearly $1.5 billion in annual sales within five years of the scheduled Jan. 1, 2024, start.

But there’s a catch: The measure passed includes a clause pushed by the Senate that will require the General Assembly in 2022 to reenact a number of provisions of the bill, including those that detail the regulatory and market structure such as licensing.

Virginia would become the country’s 16th state and the first in the South to legalize adult-use marijuana as soon as Gov. Ralph Northam signs the bill, as he is expected to do.

Northam, a Democrat, vowed to push for adult-use legalization during this legislative session.

The House of Delegates passed the compromise bill 47-44 while the Senate approved the measure 20-19.

“Virginia legislators are proving that it is possible to work swiftly to pass legislation that would not only legalize cannabis, but also address the disproportionate harm caused by decades of prohibition,” Steve Hawkins, Marijuana Policy Project’s executive director, said in a statement.

“Virginia is on the brink of becoming the 16th state to end cannabis prohibition and replace it with sensible legalization and regulation for adults 21 and over. ”

Once the bill becomes law, Virginia will be the third state to legalize a recreational marijuana market via the legislature and not at the ballot box, following Illinois in 2019 and Vermont in 2020.

In a compromise reached by Virginia lawmakers in a conference committee, legislators agreed to establish an independent agency, the Cannabis Control Authority, to oversee an adult-use market. That agency will convene this summer.

The measure also establishes a Jan. 1, 2024, enactment date for the law. Retail sales would begin then, as long as lawmakers reenact the provisions that would enable a commercial market.

House Majority Leader Charniele Herring, an Alexandria Democrat, indicated Saturday during the legislative session that she and others will fight to ensure that Virginia’s legalization measure isn’t undone. The social equity provisions in the bill also will need to pass again next year.

Legalization in Virginia reflects the domino effect that is occurring along the East Coast after New Jersey voters approved adult-use marijuana last Nov. 3.

Virginia’s House of Delegates and the state Senate earlier this month passed two separate legalization bills, so a conference committee had to resolve the differences.

First-year sales could reach $400 million-$500 million

Marijuana Business Daily projects that Virginia’s adult-use sales will reach $400 million to $500 million in the program’s first full year and $1.2 billion-$1.4 billion by its fifth year.

Projections are based on no changes occurring in the federal government’s legal stance toward marijuana.

The legislation emphasizes licensing opportunities for small and minority-owned local businesses.

A scheduled 2024 market launch would be a year later than what Northam wanted.

But it gives the state ample time to create the Cannabis Control Authority and advisory board that will oversee the market and develop a regulatory framework.

Subject to reenactment next year, the legislation agreed to by the conference committee would impose a ceiling on licenses across the different sectors of the industry:

- Retail stores: 400.

- Wholesalers: 25.

- Manufacturing facilities: 60.

- Cultivation facilities: 450.

The measure also includes the following provisions:

- Vertical integration would be limited to small businesses.

- Social equity licenses would be distributed early on in the licensing process. Qualified applicants would have to hold at least a 66% ownership stake in the business. Recipients would have access to low-interest loans to help overcome the hurdle of raising capital.

- Adult-use marijuana product sales would be taxed at 21% in addition to the standard state sales tax of 6%. Municipalities could charge up to an additional 3%.

State’s MMJ market in infancy

Virginia launched a commercial medical cannabis market only last October.

Five medical marijuana vertical operators were licensed, with each dominating a separate area.

The MMJ operators include three multistate companies – New York-based Columbia Care, Florida-headquartered Jushi Holdings and Maryland-based Green Leaf Medical – and a Virginia company called Dharma Pharmaceuticals.

One license is vacant after Los Angeles-based MedMen Enterprises, which has been struggling financially, was forced to surrender its permit.

The Marijuana Business Factbook projects Virginia’s MMJ dispensary sales in 2021 will range from $9 million to $11 million.

But the market could get a big boost later this year after Virginia lawmakers recently passed a bill approving smokable flower.

Jeff Smith can be reached at jeff.smith@mjbizdaily.com.