New data released by the Ontario Cannabis Store (OCS) reveals key details about marijuana sales and consumer preferences in Canada’s largest province, including:

- Total provincial sales approached 400 million Canadian dollars ($297.6 million) for the OCS fiscal year.

- Recreational cannabis sales are dominated by dried flower and pre-rolls amid a limited early rollout of edibles, vapes and concentrates.

- Aurora Cannabis brands lead dried flower sales both online and in retail stores.

- There was a remarkable spike in online sales at OCS.ca in March, coinciding with the COVID-19 pandemic.

The report, released Monday, covers legal cannabis sales during the OCS’ first full fiscal year, from April 1, 2019, to March 31, 2020.

Cannabis sales by category

Ontarians purchased 35.1 million grams of legal cannabis during the 12-month period for total sales of CA$385.1 million.

Of that amount, 7.2 million grams – about 20% – was sold through OCS.ca for CA$71.4 million.

The remaining 27.9 million grams were sold through private-sector retail stores, totaling CA$313.7 million.

Dried cannabis flower comprised the vast majority of Ontario’s total cannabis sales by volume (79%), although the OCS noted that flower was more available than other product categories.

More than half those flower sales (52%) were products with more than 20% THC.

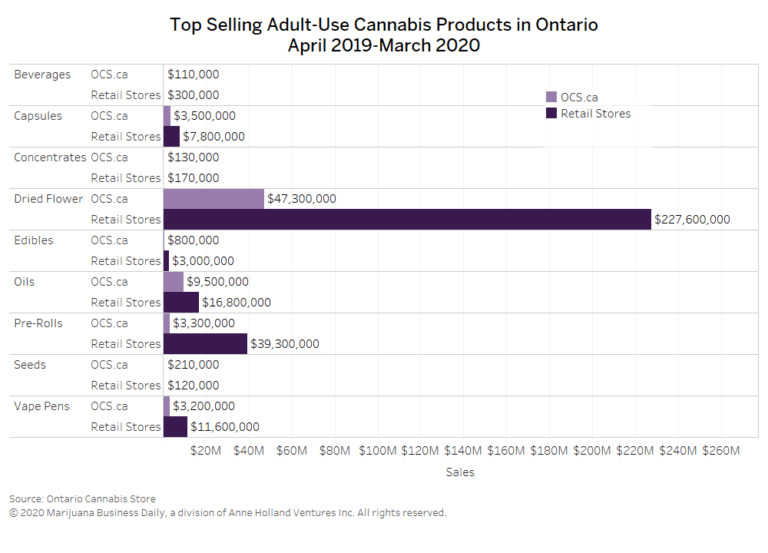

In dollar terms, Ontario’s total cannabis sales for the period were:

- Dried flower: CA$274.9 million (71.4%).

- Pre-rolls: CA$42.6 million (11%).

- Ingestible oils: CA$26.3 million (6.8%).

- Capsules: CA$11.3 million (2.9%).

- Seeds: CA$330,000 (less than 1%).

Sales of cannabis 2.0 products were comparatively small, because those products didn’t come out until the fourth quarter of the OCS’ fiscal year and supplies were often limited:

Sales of cannabis 2.0 products were comparatively small, because those products didn’t come out until the fourth quarter of the OCS’ fiscal year and supplies were often limited:

- Vapes: CA$14.8 million (3.8%).

- Edibles: CA$3.8 million (1%).

- Beverages: CA$410,000 (less than 1%).

- Concentrates: CA$300,000 (less than 1%).

- Topicals: CA$40,000 (less than 1%).

The sales data for cannabis 2.0 products “demonstrates consumer enthusiasm, but it will likely take some time for identifiable trends to emerge,” the OCS report noted.

COVID-19 sales a boost to OCS.ca

Sales data for e-commerce website OCS.ca illustrates the dramatic increase in cannabis sales as the COVID-19 pandemic hit Canada in March.

From April 2019 to February 2020, the number of monthly transactions on OCS.ca ranged from 55,600 to 74,500.

As public health lockdowns began in March, the number of transactions surged to 114,400.

OCS.ca expanded its direct-to-door delivery service in the wake of that surge, although that time period is not captured in the new report.

All told, OCS.ca boasted 4.4 million unique visitors during its fiscal year.

For every 100 customers to browse OCS.ca during the year, 7.52 made a purchase.

The average spend per order was CA$90.12 before tax, with an average of 9 grams per order.

Top-selling brands include Aurora, Redecan

The OCS report also shows the top-selling recreational cannabis brands in Ontario during the fiscal year.

For dried flower, Aurora Cannabis’ San Rafael ’71 and Aurora brands led sales both at OCS.ca and in retail stores, with each brand comprising 8% of sales through each channel.

Dried flower from Redecan accounted for 7% of sales through both channels.

At OCS.ca, dried flower from Pure Sunfarms comprised 6% of sales for the fiscal year, followed by Canopy Growth’s Tweed-brand flower at 5%.

In retail stores, Organigram’s Edison cannabis brand earned 7% of sales, with Pure Sunfarms accounting for 6%.

Pre-rolls from Flowr led category sales through OCS.ca at 8%, followed at 5% each by pre-rolls from Aurora, Aphria’s Solei brand, CannTrust’s Liiv brand and Redecan.

In retail stores, pre-roll sales were dominated by the Aurora brand (12%), followed by Tweed (8%), RIFF by Aphria (7%) and Organigram brands Trailblazer (6%) and Edison (5%).

Solei-brand ingestible cannabis oils led the oil category both online and in stores, at 24% and 23% of sales, respectively.

Early data for cannabis 2.0 products shows Redecan leading the vape category, with 14% of sales on OCS.ca and 24% of sales in stores.

Aurora’s Drift brand topped the edibles category with 27% of sales on OCS.ca and 25% in stores.

Ontario’s cannabis store count grows

Retail cannabis stores have been slow to roll out across Ontario – only nine were open at the beginning of the OCS fiscal year in April 2019.

By the end of the fiscal year on March 31, 53 stores were open to serve the province’s population of 14.7 million.

But the pace of new store openings is picking up after the provincial government opened up the market this spring, with OCS reporting 87 shops operating to date.

Increasing the number of licensed cannabis stores in Ontario “is the top priority in the fight against the illegal market,” according to the OCS report.

Legal cannabis stores in Ontario sold an average of 3,100 grams per day per locations, earning average daily sales of CA$25,000.

The OCS’ wholesale pricing to retail stores is marked down 25% from its online direct-to-consumer prices, and retailers may set their own prices.

In the coming fiscal year, OCS said it expects the average price difference between its online store and retail shops “to come into further alignment with more competition among retail stores (with the open allocation of licensing) and new value-driven retailers that enter the marketplace.”

Solomon Israel can be reached at solomon.israel@mjbizdaily.com

For more of Marijuana Business Daily‘s ongoing coverage of the coronavirus pandemic and its effects on the cannabis industry, click here.